Increasing Adoption of Automatic Tire Inflation System in Utility Vehicles to Augment Sales through 2031

May 20, 2021

2021 Analysis and Review: Automatic Tire Inflation System Market by Sales Channel – Original Equipment Manufacturer (OEM) and Aftermarket for 2021 - 2031

Dubai, United Arab Emirates - May 19, 2021 /MarketersMedia/ —

ESOMAR-certified consulting firm Future Market Insights has published a report on the global automotive tire inflation system market for the forecast period of 2021 and 2031. As per the study, the market posted significant gains during the historical period backed by the increasing application in tractors, utility vehicles and advancement in original equipment manufacturers.

According to FMI’s analysis, the market is set to register growth at a positive pace, registering a CAGR of over 5% through 2031. Surging demand for various components such as hub caps, wheel components, and hoses will fuel the growth prospects. Reliability and cost-effective features of automatic tire inflation systems will provide robust growth opportunities for manufacturers over the coming years. Limited shelf life due to the continuous movement of its rotary joint is likely to act as restraint for the market despite the heavy demand from automotive industry.

To Get Sample Copy of Report Visit @ https://www.futuremarketinsights.com/reports/sample/rep-gb-2733

However, increasing research & development activities for developing technologically advanced system and demand from advanced automotive industry will overcome the constraints of the market. Furthermore, extensive usage of automotive tire inflation system in utility vehicles and advanced manufacturing infrastructure across developed nations such as Germany, and United States will augment the sales.

Key Takeaways from FMI’s Automatic Tire Inflation System Market Study

By vehicle type, utility vehicles will emerge as primary automatic tire inflation system end-users

Original equipment manufacturers of automatic tire inflation systems will hold major market share during the forecast period

Sales across the original equipment manufacturers segment are likely to surpass an impressive valuation over the forecast period

US to experience noteworthy expansion amid robust presence of regional level tire manufacturers

Germany will generate lucrative opportunities across Europe backed by surging demand of utility vehicles in the country

Backed by surge in demand from automotive industry & ever expanding manufacturing hub, China will be the hotspot for automation tire inflation system manufacturers

Broadening automotive industry is expected to widen automatic tire inflation systems adoption across India

“Visibly increasing consumer inclination towards utility vehicles and increasing application of tractors in automotive industry are likely to amplify sales of automatic tire inflation systems by prominent automotive manufacturing,” says the FMI analyst.

Competitive Landscape

Dana Incorporated, Meritor Inc., EnPro Industries Inc., Nexter Group, Servitech Industries Inc., Hendrickson USA LLC, Tire Pressure Control International Ltd., PTG Reifendruckregelsysteme GmbH, Aperia Technologies Inc., Systems GmbH, Bigfoot Equipment Ltd., Tibus Offload Ltd. & Co. KG, AIR CTI, FTL Technology Ltd., and Col-Ven S.A. are some prominent players operating in the automatic tire inflation system market.

For More Details, Ask Analyst @ https://www.futuremarketinsights.com/ask-question/rep-gb-2733

Organic and inorganic strategies such as mergers & acquisition among top key players remains key focus area for manufacturers. For instance, in November 2020, Dana Incorporated announced the acquisition of light-vehicle thermal business from Modine Manufacturing Company.

Manufacturers are also focusing on improving their product quality to expand their regional footprints and improve the sales of automatic tire inflation system. Pressure System International, for instance, announced in September 2019, the enhanced partnership with Meritor Tire Inflation System, and incorporated advanced technology that improved the sales to 1.5 million automatic tire inflation system.

Also, recently, SAF Holland announced the launch of automatic tire inflation system in utility and commercial vehicles, designed to maintain consistent air pressure within multiple tires by addressing both over and under inflation, and also incorporated the alarm system to warn the driver when the tire needs immediate attention.

More Insights on the Global Automatic Tire Inflation System Market

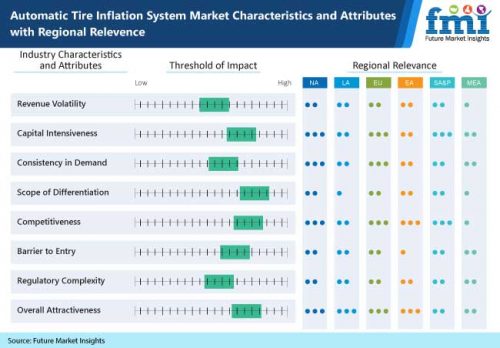

In its latest report, FMI offers an unbiased analysis of the global automatic tire inflation system market, providing historical data for the period of 2016-2020 and forecast statistics for the period of 2021-2031. In order to understand the global market potential, its growth, and scope, the market is segmented on the basis of vehicle type (tractors, heavy commercial vehicles (HCV), and utility vehicles), sales channel (original equipment manufacturer (OEM), and aftermarket), component (hub caps, hoses, axle & wheel component, and others) across seven major regions (North America, Latin America, Europe, East Asia, South Asia, Oceania and Middle East & Africa)

Download Complete TOC of this Report @ https://www.futuremarketinsights.com/toc/rep-gb-2733

About the Automotive Division of FMI

The automotive division of FMI offers a novel approach and innovative perspective in the analysis of the industrial automation market. Comprehensive coverage of capital, portable, process, construction, industrial, and special purpose machinery across the manufacturing sector and distinctive analysis about the installed base, consumables, replacement, USP-feature-application matrix make us a pioneering voice in the industry. We are preferred associates with established as well as budding industry stakeholders, and channel partners when it comes to sustaining, growing, and identifying new revenue prospects.

Explore FMI’s Extensive Coverage on the Automotive Domain

Automatic Tires Market: In its new study, ESOMAR-certified market research and consulting firm Future Market Insights (FMI) offers insights about key factors driving demand for automatic tires. The report tracks the global sales of automatic tires in 20+ high-growth markets, along with analyzing the impact COVID-19 has had on automotive industry in general, and automotive tires in particular.

Tire Repair Patch Market: The global tire repair patch market report by FMI sheds light on the important growth dynamics expected to prevail across the 2021-2031 assessment period. Statistics of key segments have been provided across prominent geographies, along with a detailed mapping of the global competitive landscape, rendering this insight a highly effectual one.

Tire Inflating Machine Market: In its new report, the Future Market Insights (FMI) offers an exhaustive overview of the global tire inflating machine market with focus on the key market dynamics, including drivers, trends, opportunities, restraints, and detailed information about the global tire inflating machine market structure. The market study presents exclusive information about how the market will grow during the forecast period of 2021 to 2031.

Contact Info:

Name: Abhishek Budholiya

Email: Send Email

Organization: Future Market Insights

Website: https://www.futuremarketinsights.com/reports/automatic-tire-inflation-system-market

Source: MarketersMedia

Release ID: 89016740

YOUR NEWS, OUR NETWORK.

Do you have Great News you want to tell the world?

Be it updates about your business or your community, you can make sure that it’s heard by submitting your story to our network reaching hundreds of news sites across 6 verticals.